Check the validity of a VAT Number and receive a free PDF Print Out of the EU VAT VIES record of enquiry

CharlotteWooning.com uses Valdit VAT Check

when exporting exclusive designer jewellery.

Image © CharlotteWooning.com

Checking the validity of an EC customer's VAT registration number *)

You should check the validity of the customer’s VAT registration number when zero-rating supplies to VAT registered customers in another Member State. Checks on the validity of a customer’s number should be made using the Europa website.

When making an enquiry on the Europa website you must identify yourself by entering your own VAT registration number and print out a record of the date and time that the enquiry was made and the result of the enquiry. If it later turns out that the customer’s number was invalid, you will be able to rely on the validation record as one element to demonstrate your good faith as a compliant business and to justify why you should not be held liable for any VAT fraud and revenue losses which occur.

*) Except from GOV UK VAT Notice 725: the single market

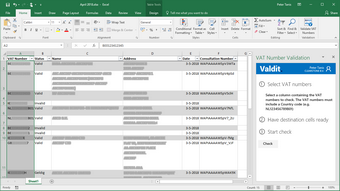

Valdit VAT Check explained

Valdit VAT Check makes the enquiry to the Europa VAT VIES service on your behalf. When making the enquiry, we create a free PDF print out of the results and send it to you by email:

You enter the VAT Number(s) for the enquiry

We'll run a quick check on the EU VAT VIES service

And tell you the results immediately

If you like to receive a PDF of the enquiry result, you provide your Company's VAT number and your Email address

We’ll make an official VAT VIES enquiry on your behalf

And send you a free PDF that you can keep for your records