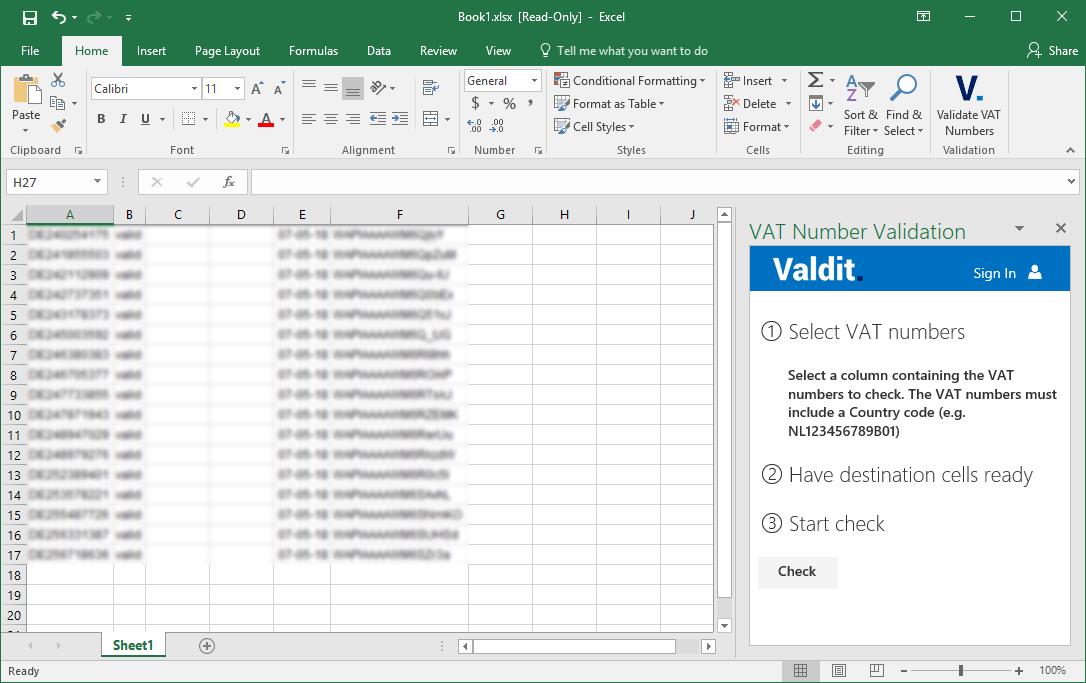

VAT Number Validation Add-in for Excel

Is validating VAT numbers an ongoing responsibility for you? And is it a time-consuming process? Would you like to use a simple and efficient solution for checking hundreds of VAT-numbers?

The Valdit VAT Number Validation Add-In for Excel 2016 helps you by simplifying VAT Number Checks, checking multiple numbers fast and streamlining your Compliance Processes!

Licensing

A Valdit account is needed to use the VAT Number Validation Add-In. After registering your Valdit account, you can start a One Month Free Trial that allows you to verify if the Valdit VAT Number Validation Add-In meets your business needs. The Free Trial ends automatically. No Credit Card is required.

Price Plans

Free Trial

- 800 VAT checks

- One Month Free Trial

- Single User

- Email support

Subscriptions are billed annually. Prices indicated are in Euro and excluding VAT.