Perform a validation on a new EU VAT number

Below is an overview of the main components of the Valdit VAT Validation API:

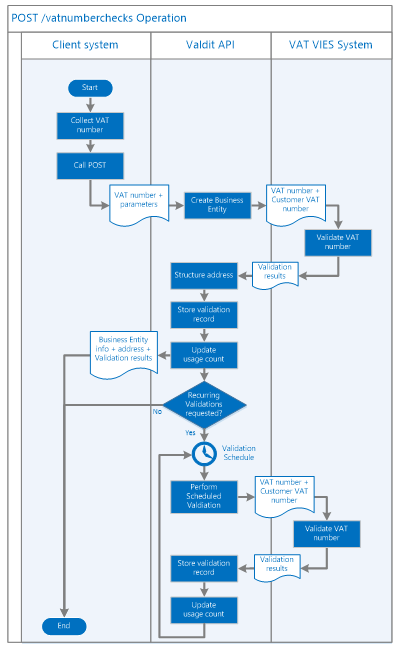

This flow is used to make a first time validation on a VAT number. Typical examples are:

- The entry of a new customer in a CRM (Customer Relationship Management) system

- The entry of a new business partner in an ERP system

- The registration of a customer during checkout in a B2B web shop

Preconditions

- The new EU VAT number is known in the Client system. It consists of a two letter country code followed by the national VAT number. An example is BE0420834005.

- The VAT number has not been registered before in the Valdit VAT Validation system by the Customer.

Results

- The VAT number is validated against the VAT VIES system. The results are available to the Client System

- A new Business Entity, identified by the VAT number, is registered in the Valdit VAT Validation system

- The address of the Business Entity is available in structured format to the Client System

- A Validation Record is stored in the Valdit VAT Validation system

- One validation has been added to the total usage count for the Customer

- If Requested: The scheduled Automated validations have been started for this Business Entity

This flow uses the POST Operation, which creates a Business Entity and performs the first validation for a new VAT number. The client sends the VAT number to the API, which performs the validation and returns a newly created Business Entity together with the validation results and structured address.

Figure 3: POST Operation Sequence diagram