Reduce VAT risks by early validation and maintaining records

Run Automated validations to enhance Compliancy

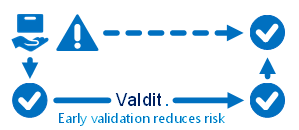

It is not uncommon for businesses to perform the validation of a VAT number as late as the time of Tax Filing. However, the risks of VAT exempt deliveries or services are taken when making a sale to the customer. Between the time of sale and the Tax Filing a customer’s status may have changed. VAT number validation for a date in the past is not supported by the EU VAT VIES service. Therefore, validation of VAT numbers should be done at the earliest possibility in the business processes.

National Tax Administrations may require evidence that a VAT number has been validated, to justify the VAT exemption of intra-community supplies of goods or services. When validating a VAT number, the EU VAT VIES service will issue a unique Consultation Number. The Consultation Number can be used to prove to a Tax Administration of a Member State that you have checked a given VAT number at a given time, and obtained a given validation reply. The Consultation Number is therefore essential in reducing VAT risks and should be maintained as a record.

The Valdit VAT Validation API will maintain records of every validation that is performed on your behalf. If you ever need to provide evidence that you have correctly validated a VAT number, you can simply prove compliancy by accessing your validation records through the API.